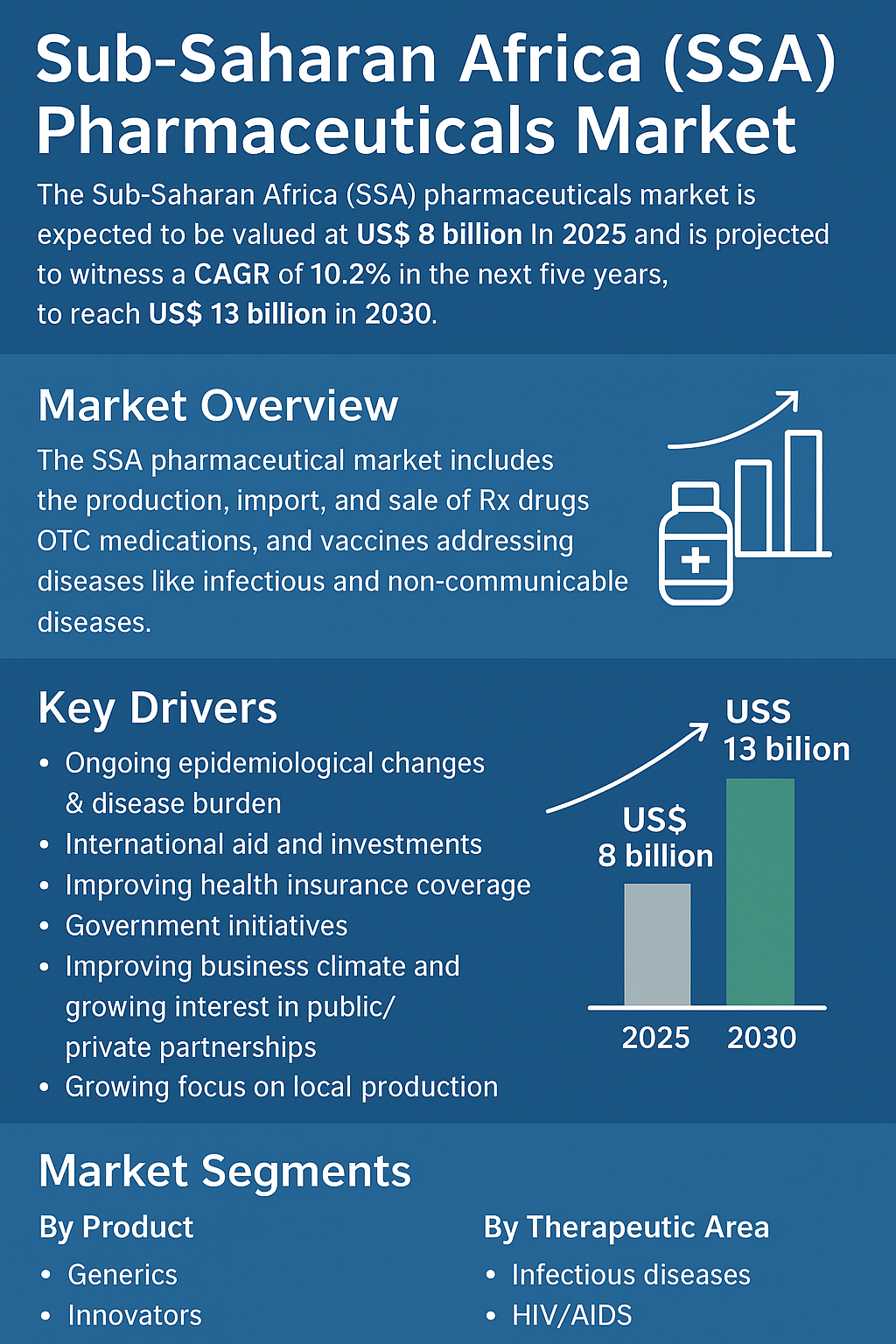

The Sub-Saharan Africa (SSA) pharmaceuticals market is entering a pivotal growth phase, projected to expand from USD 8 billion in 2025 to nearly USD 13 billion by 2030, registering a robust CAGR of 10.2%, according to a comprehensive new market study. This surge is attributed to ongoing epidemiological transitions, international aid, expanding health insurance coverage, government initiatives, public-private partnerships, and a rising focus on local pharmaceutical production.

The SSA pharmaceutical market encompasses the production, import, and sale of prescription drugs, over-the-counter (OTC) medications, and vaccines aimed at combating both communicable and non-communicable diseases (NCDs). With a growing and diverse population, the region’s pharmaceutical sector is strategically positioned to play a central role in addressing infectious diseases such as HIV/AIDS, tuberculosis, and malaria, while also meeting the rising demand for cardiovascular, cancer, diabetes, and metabolic treatments.

Market Overview

The Sub-Saharan Africa pharmaceuticals market represents one of the most dynamic healthcare sectors globally, shaped by disease burden, population growth, urbanization, and policy reforms.

- The region has historically been dominated by communicable diseases, but the past decade has witnessed a steady shift toward non-communicable diseases, driven by changing lifestyles and a rising elderly population.

- With 1,800 public health emergencies reported between 2001 and 2022, including outbreaks of Ebola, cholera, meningitis, and monkeypox, the need for robust pharmaceutical solutions remains urgent.

- At the same time, diabetes, cardiovascular disease, arthritis, and cancer are emerging as major health concerns, creating a dual demand for infectious and chronic disease management.

This epidemiological transition is compelling governments, private enterprises, and multinational pharmaceutical companies to accelerate investments across the SSA pharmaceutical value chain.

Key Drivers Fueling SSA Pharmaceuticals Market Growth

1. Ongoing Epidemiological Changes & Disease Burden

The dual burden of infectious diseases and NCDs is reshaping the pharmaceutical landscape. Countries such as Ethiopia, Kenya, and Tanzania are among the top 30 globally with high multidrug-resistant TB cases. Meanwhile, lifestyle-related diseases such as hypertension, diabetes, and obesity are rising rapidly in Nigeria, Ghana, and South Africa. This creates consistent demand for a broad spectrum of medicines, from antiretrovirals and antibiotics to cardiovascular drugs and oncology treatments.

2. Expanding Health Insurance Coverage

National health insurance programs are improving drug accessibility while reducing out-of-pocket costs.

- Kenya’s NHIF has boosted uptake of chronic disease treatments.

- Ghana’s NHIS ensures access to essential medicines for a wider population.

- Tanzania’s community-based insurance program has increased affordability of medicines.

This expanded coverage directly translates to higher pharmaceutical sales and improved treatment outcomes.

3. Government Initiatives & Investments

Governments across SSA are strengthening regulatory frameworks, incentivizing local production, and expanding healthcare infrastructure. In addition, international aid from WHO, the Global Fund, and Gavi continues to fund vaccines and essential medicines, enhancing accessibility.

4. Growing Focus on Local Production

Local manufacturing is emerging as a cornerstone of pharmaceutical security. Countries such as Nigeria, Kenya, and Ethiopia are encouraging public-private partnerships to boost local drug production and reduce reliance on imports. This not only lowers costs but also fosters employment and knowledge transfer.

Market Challenges Hindering Expansion

Despite significant growth prospects, the Sub-Saharan Africa pharmaceuticals market faces structural barriers:

- Regulatory inconsistencies across countries hinder cross-border trade.

- Counterfeit medicines undermine safety and consumer trust.

- Supply chain inefficiencies delay delivery of essential drugs to rural and semi-urban areas.

- Healthcare professional shortages limit effective distribution and prescription.

Addressing these challenges will be critical to sustaining long-term growth.

Opportunities in SSA Pharmaceuticals Market

While challenges persist, several opportunities are shaping the future trajectory of the SSA pharmaceutical industry:

- Growing confidence in generic medicines is creating a massive opportunity for affordability and accessibility.

- Collaborations between multinational corporations (MNCs) and local manufacturers are enhancing production capabilities.

- Non-communicable disease (NCD) therapies such as cancer treatments, insulin, and cardiovascular drugs are expected to see rapid adoption.

- Vaccine innovation and local clinical research are gaining momentum, supported by supranational organizations.

Market Segmentation

The SSA pharmaceuticals market is segmented by product type, therapeutic area, and country.

By Product

- Generics – Dominating due to affordability and wider acceptance.

- Innovators – Steadily gaining traction, particularly in specialized disease management.

By Therapeutic Area

- Infectious Diseases

- HIV/AIDS

- Cardiovascular

- Metabolic Disorders

- Oncology

- Ophthalmology

- Dermatology

- Gastroenterology

- Others

By Country

The market outlook covers Nigeria, Ethiopia, Kenya, Tanzania, Angola, Ghana, Côte d’Ivoire, Senegal, Cameroon, Burkina Faso, Zimbabwe, Zambia, Mauritius, Botswana, and Namibia.

- Nigeria leads the SSA market due to its large population and growing middle class.

- Kenya and Ghana are experiencing rapid adoption of health insurance, fueling growth.

- Ethiopia and Tanzania are emerging as strong manufacturing hubs.

Competitive Landscape

The SSA pharmaceuticals market is highly competitive, with both multinational corporations and local companies playing vital roles.

Key players include:

- Cipla Limited

- Aspen Pharmacare

- Sun Pharmaceutical Industries Limited

- Shalina Healthcare

- Ajanta Pharma Limited

- Emzor Pharmaceutical Industries Ltd

- Fidson Healthcare Plc.

- Sanofi

- Pfizer Inc.

- GlaxoSmithKline plc

These companies are pursuing strategies such as product innovation, mergers & acquisitions, strategic collaborations, and regional expansions to strengthen market presence.

Report Highlights

- Market Valuation: USD 8 billion (2025) → USD 13 billion (2030)

- Growth Rate: CAGR of 10.2%

- Primary Drivers: Epidemiological changes, health insurance expansion, local production initiatives, and government support.

- Opportunities: Generics growth, NCD treatments, and local partnerships.

- Challenges: Counterfeit drugs, regulatory fragmentation, and supply chain limitations.

source: Sub-Saharan Africa (SSA) Pharmaceuticals Market Size & Trends Report

Email: ben@satprwire.com Phone: +44 20 4732 1985

Ben has been listening to the technology news for quite some time that he needs just a single read to get an idea surrounding the topic. Ben is our go-to choice for in-depth reviews as well as the normal articles we cover on a normal basis.